The UK self storage industry is maturing quickly. After its birth in the 1960s in the USA and arrival in the UK in the 1980s, it has quickly taken hold to become a part of the culture of the country. Although much of the rest of Europe lags behind the UK, self storage is gaining momentum there too.

In this article, Steve Jordan talks to Rodney Walker CBE, CEO of the UK Self Storage Association (SSA UK) and Secretary General for the Federation of European Self Storage Associations (FEDESSA), to find out more.

The SSA UK has around 230 member companies (including suppliers) operating some 540 facilities. These range from small companies, some formed as moving companies diversified, to the self storage giants such as Big Yellow. A report undertaken by Mintel in 2009, shows that over the previous five years the number of self storage sites in the UK had grown by between 8%-15% - generating revenues of approximately £360 million and employment for 2,700 people.

Although the industry has grown it’s still tiny compared with the US. The last two years have seen a temporary halt as companies have consolidated to keep their stores full. “The US currently uses 7.5 sq ft of self storage per person and the UK only uses 0.5 sq ft,” Rodney explained. “If you compare us with the United States we haven’t started yet. Self storage is a part of their life.”

Rodney suspects that the early rise of self storage in the US and its continued success is because Americans tend to move around a lot more than we and our fellow Europeans have done in the past. “If you are a successful business man today, you don’t have a home any more: you’ve got to be mobile.”

But the UK is still ahead of many other countries in Europe. There are currently 800 primary facilities in the UK and 8 – 900 across the whole of the rest of the EU and Rodney thinks it is just a matter of time before Europe catches up. “Sweden is already on a par with the UK and Holland is not far behind,” he said.

Rodney believes that as we all become more mobile, then our need for self storage will increase. The biggest hurdle to the success of self storage has been the awareness of the product. According to SSA UK research only 50% of the population in the UK are now aware of self storage largely due to the number of sites.

What goes into self storage

There is no real direct competition to self storage. The competition for the industry comes from garages that no longer house cars; packed sheds; crammed inaccessible lofts; and overly cluttered homes. “The major reasons individuals use self storage is for life time events like downsizing, smaller houses, divorce, longevity and getting married later in life. Younger people have acquired goods they cannot fit into ever smaller flats and houses. Young people love self storage for its flexibility, convenience and 24-hour access.”

There is no real direct competition to self storage. The competition for the industry comes from garages that no longer house cars; packed sheds; crammed inaccessible lofts; and overly cluttered homes. “The major reasons individuals use self storage is for life time events like downsizing, smaller houses, divorce, longevity and getting married later in life. Younger people have acquired goods they cannot fit into ever smaller flats and houses. Young people love self storage for its flexibility, convenience and 24-hour access.”

However, despite around 50% of self storage being in some way related to the housing market, much is used for purely commercial purposes. “36% of customers are business users that use self storage for start-ups, e-Bay businesses and archiving,” said Rodney. It’s also true to say that the flexibility of self storage has provided opportunities for businesses to operate that simply would not have existed in the past. Statistically, business customers stay twice as long in their units as domestic users: 56 weeks compared with 27.

Recession resilience

Although self storage is undoubtedly resilient to recession, it’s not immune. The growth it had been enjoying ground to a halt a couple of years ago, only 15% of companies expanded, less than 10% expect to be opening more than one store before 2014, the mature facilities are only two-thirds full, and most operators have paused their expansion plans.

However, there is still growth as the excess space has been filling up and although there are very few new facilities being built, the interest in the product is still there. Land and property owners still look to self storage as an option for utilising spare warehousing space. Prices took a hit in 2009, but not a big one. In 2008 the average billed room rate for a 25sq ft space across the UK was £21.08; in 2009 it dropped to £20.49 (less than 3%) only to bounce back to £21.97 in 2010 – more than 4% aggregate increase over the two years. In London the figure was £29.54; in the north of Scotland this dropped to £15.35.

“The self storage industry has been reasonably resilient to recession,” said Rodney. “Everyone is saving money; when sentiment changes, business will improve. I genuinely think this industry has a long way to go. It is part of the structure of this nation.”

| The following statistics come from the SSA UK annual survey report 2011 compiled by Drivers Jonas Deloitte. - 30% of facilities are purpose built and are located in London and the South-East;

- 36% (of the 800 primary facilities) are owned by the seven largest companies;

- The UK self storage market has not yet reached maturity;

- The US rents per sq ft are much lower than the UK;

- 50% of storage tenancies relate to the housing market;

- Business customers stay twice as long as domestic: 56 weeks against 27 weeks;

- Only 15% expanded their portfolios in the last 2 years;

- Less than 10% expect to open more than one new store before 2014;

- Operators have paused their expansion plans and are concentrating on growing income from existing outlets;

- Among mature facilities (5 yrs) just over two-thirds of lettable space was occupied;

- Prices dipped in 2009 but recovered in 2010;

- London has the highest room rate at approximately £30.00;

- 39% of rates increased less than inflation;

- Average self storage turnover is £300k;

- 40% website enquiries, 25% signage;

- Most facilities have CCTV across the whole building and nearly a third provide individual room alarms.

|

Opportunity for movers

Estimates are that only 5% of moving companies that could profitably convert some of their warehouse facilities to self storage have done so. Competing with the big self storage companies is difficult, as they have more cash to spend on marketing, but the opportunities are there nonetheless. Most moving companies that take the plunge have said that their self storage units are profitable and provide a low-cost income for the future.

Estimates are that only 5% of moving companies that could profitably convert some of their warehouse facilities to self storage have done so. Competing with the big self storage companies is difficult, as they have more cash to spend on marketing, but the opportunities are there nonetheless. Most moving companies that take the plunge have said that their self storage units are profitable and provide a low-cost income for the future.

Rodney thinks that the lack of uptake is because a number of independents do not have the drive and ambition to want to ensure that their facility is a separate entity and sufficiently secure. “A lot of moving companies have moved into self storage in stages. For example, they have allowed people to store in their warehouses. They may have containers in their yards or use garage units. But my advice is that they should follow the best practice guidelines as set out by the SSA UK.”

Rodney said the capital outlay is substantial and the store facility needs to be filled up as quickly as possible, virtually at any price, to gain back revenue before increasing prices. “Although staffing levels are tiny, there are substantial costs involved in property and conversion to a separate facility with security being a top requirement. Attention must also be given to planning and fire regulations. Self storage customers are responsible for their own goods and they need to provide their own insurance.”

Location has always been important for self storage; however the rise of the Internet has reduced the dependence on passing trade. Now over 40% of enquiries come from websites. Signage is, however, still the second most important way to get a message across so a ‘through route’ site is very valuable. But Rodney advises site owners not to rely simply on the Internet and signage to do the marketing. “Customer base is an important part of any business and leaflets still need to be delivered to solicitors, property agents and removal companies. Marketing spend will need to be maintained to keep the units filled.”

Security

Self storage facilities are becoming a greater target every day for the criminal fraternity. The industry is vulnerable to illegal contraband and other illegal activity.

Rodney explained that, to combat this, all SSA UK members receive a security advice manual and the SSA UK has developed a close relationship with security agencies and the police. “It is important to over watch your facility not only with CCTV and intruder alarms, but make sure that your customer base is vigilant in spotting and reporting any signs of illegal activity.”

The SSA and FEDESSA

The majority of the main operators in the UK are members of the SSA UK. The benefits of membership include: networking and the fellowship enjoyed by working with other companies in the industry; access to the licence agreement that sets out terms and conditions; and advice on insurance, security and legal matters. In the future Rodney hopes that the Association will be used more as a sales tool to make the public more aware of the best practice guidelines adopted by members.

FEDESSA is the European organisation that deals internationally and oversees 14 national associations. Although the two organisations have separate boards of directors, much of the activities of FEDESSA are controlled by Rodney’s office including the joint SSA UK/FEDESSA magazine and the annual conference.

Self storage - view from the top

Even those moving companies that have fully embraced self storage would be scratching the surface by comparison with the market leaders. Here The Mover interviews two of the UK’s top companies for their opinions on the past and the future of self storage.

The last few years have been difficult for the moving industry. Being so tied into the housing market has meant thin pickings and, for many, it’s only been their storage business that has kept them operating. Self storage has been seen as largely recession proof and a life saver for any company that had the foresight to get in before the recession hit. But, from the market leaders’ points of view, the recession hit pretty hard too.

Adrian Lee is the Operations Director for Big Yellow. His company has 65 stores in the UK, mainly in the South and South-East, turns over 62 million, has 50,000 customers and a staff of 300. “We noticed the recession immediately in 2007 after the collapse of Northern Rock,” he said. “2008 and 2009 were pretty tough years for self storage but relative to other businesses not as bad as you would think. The recession impacted us in terms of revenue by about 8-9% [like for like earnings] peak to trough over the two years. That has since been recovered and today we are ahead of were we were at the peak of 2007.” Adrian pointed out that the company continued to grow over that period by continually opening new stores.

Dave Davies, Director at Safestore, agreed with Adrian. His company has 98 stores throughout the UK and another 24 in Paris. His company also has a management contract for 12 stores with Space Maker. “In 2007 the enquiries stopped for about three months,” he said. “With hindsight I think people just became uncertain. People just put on hold everything they were planning to do, they stopped spending. But then as the interest rates fell and people had a little more money, they just started to get on with their lives.”

Interestingly Dave said that for Safestore the decline in domestic was compensated by a much bigger business growth. “For example, people would not sign long leases on warehouses, they worked from home and so needed storage,” he said. “It was a very simple scenario. People who might have leased a warehoused used us instead.”

So no, the self storage industry was not insulated completely from the recession but, compared with the moving industry or estate agency, they all did very well. Adrian said that for Big Yellow 2011 was the third consecutive year of steady growth. “Like-for-like growth is at about 3% pa and total revenues are up by around 7-8%. We keep costs under control and grow earnings by 20%. It’s a pretty good business model in a tough world.” He said that the outlook was for more of the same.

That might seem attractive considering the downturn many moving companies saw over the same period. But Dave explained that his company was now working twice as hard to keep the revenue at the old levels. “We have been more creative because if it were purely driven by price we wouldn’t be in the position we are now. Some of your readers might have a tougher time than us because scale and the ability to spend money on marketing has proved to be a definite advantage when times are tough.”

Adrian also pointed out that there has been a complete change in how self storage operations market themselves from drive-by and telephone sales to the Internet. “Safestore and Big Yellow, with national brands and big support systems, such as Search Engine Optimisation and the constant development of websites, allows us to generate disproportionate benefit from the Internet.”

Global expansion Although Safestore has stores in Paris, Dave explained that this, despite the obvious opportunity for expansion into other countries, was not intended to be repeated just yet. “When times are good and the market wants growth and growing businesses I am sure that someone will exploit different markets in Europe but at the moment that’s not perceived as good wisdom and we would agree. To start again in a country you know nothing about would be very risky.”

From Big Yellow’s point of view, Adrian agreed. “We would not say never but it would involve millions of pounds of losses to invest in those markets and it’s not something we contemplate wanting to do at the moment.”

Services to movers

Many movers would consider the big self storage companies to be competitors but Big Yellow looks at the relationship differently. “We work very closely with any mover that does not provide storage,” said Adrian. “All our stores work very closely with moving partners and provide them with enquiries. That is pretty standard across the industry. Some are prepared to surrender their storage business because of the benefit they get from working with the self store company. There is more interaction between self storage and movers than you would necessarily think. Many self store operations have a moving partner parked on their forecourt.”

Security

By its very nature a self storage facility has to provide access to the public. Many moving companies are, according to the Self Storage Association, anxious about security and this is one area that prevents them from taking the plunge and setting up their own facility.

By its very nature a self storage facility has to provide access to the public. Many moving companies are, according to the Self Storage Association, anxious about security and this is one area that prevents them from taking the plunge and setting up their own facility.

However, Adrian explained that not everyone is given unfettered access. Only a small proportion of customers are given access beyond normal trading hours. “We don’t want too many people wandering around at 2am,” he said, explaining that those customers who do have access become the site’s police force. “They are very interested in security and if they see anything they are straight on the telephone.” Of course with alarms, restricted access, CCTV and remote monitoring, anyone entering a self storage facility is being watched.

If you want to store something illegal, the last place you would go to is a Big Yellow or a Safestore,” said Dave. “We would ask for identification, we’d have a picture of you on our system, and we would not let you pay cash; you would be more likely to hire a lock-up garage or rent a flat rather than come to one of our places because, you are snapped the moment you drive in.”

Big Yellow or a Safestore,” said Dave. “We would ask for identification, we’d have a picture of you on our system, and we would not let you pay cash; you would be more likely to hire a lock-up garage or rent a flat rather than come to one of our places because, you are snapped the moment you drive in.”

As an illustration, Adrian said that Big Yellow, Safestore and the SSA work very closely with the police and counter terrorism organisations and it is quite clear that some people, perhaps with criminal intent, have enquired about renting self storage units but then quickly move on when they realise the level of security involved.

Thanks to the SSA for its help in securing this interview.

Taking the plunge

Your questions answered

Have you thought about converting part of your warehouse to self storage, but not yet taken the plunge? Here’s a Q&A with Richard Allen, of Active Supply and Design, to help you make up your mind.

| Q: What proportion of UK movers that have appropriate premises for self storage have converted some of their warehouse? A: A relatively small proportion of removers have added self storage to their business interests. The removers that have added self storage to their portfolios report increased revenues and strong interest in the sector even throughout the recent downturn. | Q: Is there a rule of thumb to help people work out how much it will cost? A: Anyone looking for budget costs for fit-out can find the information they need at www.askactive.com, providing they register at the site a spreadsheet can be accessed that will produce costs and potential returns. Alternatively call Richard at the Active office on 01270 215200 for a chat about the viability of your project and associated costs. |

| Q: What is the ideal type of premises for conversion? A: Most premises are suitable for some form of conversion; ideally buildings would have enough height to take advantage of the increased space offered by a mezzanine floor. This is quite common in removers’ warehouses as many have the facility to stack wooden containers three or four high which, as a simple guide, equates roughly to the amount of mezzanine floor tiers the building will accept. Other features that would prove beneficial are good access and yard space and, if retaining crate storage, the ability to segregate the two storage offerings. | Q: Are self storage facilities all the same? If not, what’s the difference between good and ordinary? A: Facilities vary tremendously in many ways with the vast majority being very profitable for the operator concerned. The better facilities are designed to make maximum use of available space to ensure enhanced revenues. These facilities will also offer a good variety of unit sizes, be clean and functional throughout with good management and keen, customer focused staff. A strong brand name within the local community is also a huge asset. |

| Q: How important is location nowadays? A: Location was once the holy grail of self storage as lack of public awareness of the product required a facility to be in a prime position. With a much increased industry profile, and the emergence of the Internet as the preferred search method, location has become less of an issue, with some operators reporting that 70% of enquiries originate from the web. However, after taking this into account, the facility should still be easy to find and offer good vehicular access with a prominent entrance. Certain areas of the country are well developed whilst there are still large pockets of the UK under serviced by the self storage industry. | Q: What would be your advice to anyone considering setting up a self storage facility for the first time? A: Talk with peers in the removals trade who have already diversified into self storage, the majority would be only too pleased to offer their advice. Help and guidance is also readily available from reputable industry suppliers, who would be more than happy to assist in the successful introduction of self storage to current business interests. Another point to note is that a self storage business should be considered as more of a retail product than traditional warehousing and benefits from the advantage of offering attractive bolt-ons to further enhance profits. |

| Q: Is change of use planning permission required? A: Change of use is not normally required by removal companies as they normally would have provision for B1 or B8 usage within their current framework. However, building regulations approval may be required. | Q: How long toes it take from start to finish? A: The duration of any fit-out & build will vary with the size of the project, our current lead time to arriving on site is approximately three to four weeks from placement of order. We will endeavour to work to our clients’ requirements at all times and often amaze our customers by the speed and efficiency we work at without sacrifice to quality. |

| Q: What is the likely pay back period? A: Rate of return is totally dependent on fill rates and location of the facility, this information is best gained from the budget spreadsheet available from our website as mentioned previously. Most operators will claim that pay back on self storage beats many other possible investments hands down. | Q: Are banks generally prepared to lend for self storage facilities? A: As we all know the banks have tightened their reigns considerably within the current economy and funding anywhere is hard to acquire. However it’s good to know that due to the nature of the business banks can often look upon self storage investment favourably. There are also other lenders keen to become involved in the self storage sector. |

Asia – an open market for self storage expansion?

55% of the world’s population lives in Asia. Yet the whole region is virtually devoid of self storage facilities. Could this be the big opportunity for storage operators over the next decade? With the benefit of statistics and comment from Steel Storage, this article aims to find out.

55% of the world’s population lives in Asia. Yet the whole region is virtually devoid of self storage facilities. Could this be the big opportunity for storage operators over the next decade? With the benefit of statistics and comment from Steel Storage, this article aims to find out.

In the USA, the home of the self storage industry, there is approximately 7 sq ft of self storage space per capita available. In Australia, another country that has been bitten by the self storage bug, the figure is 1.2 sq ft. Even in the UK, where the industry is relatively youthful, it’s 0.5 sq ft per person. In Asia it’s 0.008!

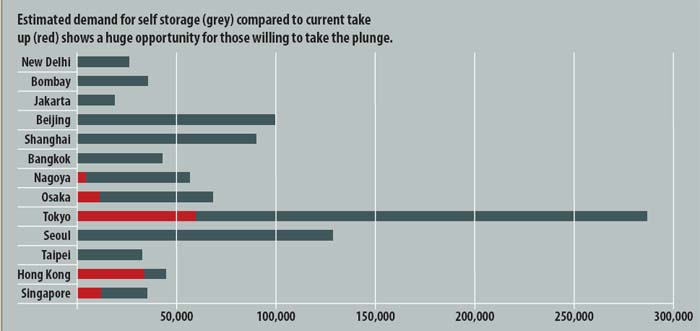

Self storage is a middle class phenomenon. It’s not until people reach a certain standard of living that they have a need for or would consider self storage. Taking a figure of US$20,000 annual income as a watershed, currently five markets in Asia have become, to some degree, middle class: Singapore, Honk Kong, Taipei, Seoul and Tokyo. Many more, including Bangkok, Shanghai and Beijing are not far off. Middle class people in Asian cities now total around 100million.

If you assume there is a market of one storage unit for every 100 middle class people, the demand is 950,000 storage units in Asia. Only 120,000 have so far been built. In the USA there is currently one self-storage unit for every 12 people; in the UK there is one for every 153 people; in Asia there is only one unit for every 6,500 people. Yes, there does appear to be a market opportunity.

So far, the only Asian countries that have made any real impact on the self storage market are Singapore, Hong Kong and Japan. But even these countries appear to have self storage industries that are not close to satisfying likely demand when compared with the US, Australian or even UK models.

So far, the only Asian countries that have made any real impact on the self storage market are Singapore, Hong Kong and Japan. But even these countries appear to have self storage industries that are not close to satisfying likely demand when compared with the US, Australian or even UK models.

The Australian market started to take off big time in around 1985. The UK and to some extent Europe did the same 10 years later. Asia only kicked into action about five years ago. There appears to be a bandwagon passing; maybe it’s time to jump on board.

The 5% Rule

As a rule of thumb, Steel Storage recommends that the correct average size of self storage units should be 5% of the size of the average home in any market.

The natural way for movers to diversify

Philip Pouncey, Managing Director, Kuboid.

Ask any removals company that has diversified in recent years to add Self Storage to their business and I would doubt that even one of them would regret doing it.

Ask any removals company that has diversified in recent years to add Self Storage to their business and I would doubt that even one of them would regret doing it.

Self Storage is a natural addition for any removals company, most have provided some form of storage (e.g. carton & open) for many years (long before us young upstarts), they understand how to sell space and usually do not need to employ additional staff. In addition they often have space available in existing buildings and therefore can put their toe in the Self Storage market without a significant investment. In fact, many removals companies have found that by offering Self Storage they have in turn increased sales of their carton storage; you can offer your customers a choice which is something even the biggest Self Storage companies cannot do.

The truth is Self Storage is nothing new; it has been around in some form for centuries; even Arthur Daley had a ‘lock-up’ in the 70’s. Surprisingly though many people in the UK are blissfully unaware of these traditional forms of storage whereas Self Storage – due to a massive marketing campaign in recent years – is becoming a recognised product in its own right.

Whether you develop a small area of an existing building to provide additional income or build a large stand alone store the criteria is the same, like in any business you must have a product that sells, therefore be sure to choose a fit-out Company that knows Self Storage. I have spent many years designing and building Self Storage facilities and have seen too many that were poorly designed and worse still unable to adapt themselves. At Kuboid we work to strict guidelines acquired through extensive research and apply this knowledge to every store that we design, it is vital to have the correct mix of storage room sizes(we like to call them storage “kuboids”), that they are located in the best position within the store, the store is logically laid out and has a welcoming ambience, not a cold uninviting warehouse.

We have also learnt that every store and every location is unique. A few years ago we built two stores in a major UK City within 3 miles of each other. After 6 months of trading I called into both stores on the same day. The first storeowner told me his 50 sqftkuboids were not very popular but the second storeowner told me his most popular size was 50 sq ft. That is why we always recommend, where both practical and possible, to build the store in phases and why we developed our product to be modular & reconfigurable.

So if you are a removals company, put your toe in the Self Storage market, you won’t regret it.

www.kuboid.co.uk