Survey by reallymoving.com reveals the cost of moving.

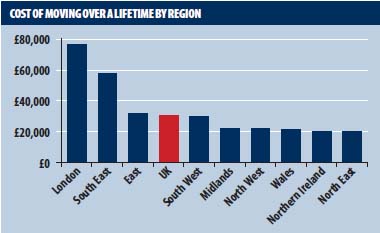

Brits are forking out almost £30,000 on home moves over a lifetime, with Londoners paying 2.5 times the national average cost as a result of significantly higher fees for conveyancing, surveys, estate agent fees and stamp duty tax, according to research from reallymoving.com, a provider of online quotes from home movers.

While the average person in the UK spends £8,264 every time they buy and sell a property, Londoners stump up £20,739 each time they move due to higher stamp duty tax (as a result of higher property values) and greater general costs. Considering people in the UK typically buy four properties during the course of their lives, this equates to a total cost of £75,972 for London residents over a lifetime compared to just £28,952 for people in the wider UK. Londoners can take some comfort from the fact that these costs are in many cases offset by consistently higher annual house price rises.

The greatest cost facing the typical UK home mover, based on an average property value of £228,000, is estate agent fees costing £4,104, followed by stamp duty tax, costing £2,280. A further £805 is spent on conveyancing for the sale and purchase, £355 on a Homebuyer's Report survey and £60 on an Energy Performance Certificate (EPC).

The total cost of a home move is equivalent to 31% of average annual national earnings, rising to 61% for people moving in London, who usually fall within the higher 3% stamp duty tax bracket. At the other end of the spectrum, home move costs in Northern Ireland are equivalent to 22% of average earnings.

Total moving costs for first time buyers are substantially lower at £3,700, since they are not required to pay for estate agency fees, conveyancing on a sale or an EPC. They may also save considerably on removals having a lesser volume of possessions to move.

Rosemary Rogers, Director, reallymoving.com said: "Taking a chunk of equity out of your sale to cover the costs of a move is no longer a viable option for many sellers who need to keep hold of their existing equity in order to secure the best possible mortgage rate on their new home. As a result, buyers are more prepared to negotiate hard with estate agents over fees and shop around for the best conveyancing and removals quotes to keep costs as low as possible. Our Moving Cost Calculator shows that contrary to popular belief, stamp duty is only the most expensive moving cost in London and the South East; in fact estate agent fees are 80% higher than stamp duty for the average UK buyer."

To calculate the cost of a home move, reallymoving's new Moving Cost Calculator adds together estimated costs for conveyancing, removals, estate agency fees, stamp duty tax, survey and EPC to give a total cost of moving.

reallymoving.com was launched in November 1999 and has become the UK's leading provider of free instant online quotes for home-moving services. The site provides instant quotes for a variety of services including domestic removals, surveys, conveyancing solicitors, Energy Performance Certificates and Scottish Home Reports and a choice between local and national service providers. For more information visit www.reallymoving.com.

About this research

This research was compiled using quote data from reallymoving.com in the three month period from 1 April to 30 June, 2012, during which a total of 77,065 quotes were generated.

- All prices are inclusive of VAT at 20% except SDLT;

- Estate agent fees are based on the average UK fee of 1.8%, according to research in January 2012 by property agent comparison website ipostcode. Total moving costs exclude estate agent fees not applicable on first purchase;

- Average earnings are based on the ASHE (Annual Survey of Hours and Earnings) released by the ONS in 2012;

- Removals quotes are based on a 3-bedroom house and the average moving distance for each region;

- Conveyancing costs are based on a weighted combination of freehold/leasehold quotes, including VAT;

- Survey (Homebuyer report) and EPC costs are based on average quotes generated for each region;

- Stamp duty fees are calculated using the most recent ONS house price data and current government Stamp Duty Tax bands;

- The research is based on an average of four property purchases in a lifetime: starter home, first family home, second family home, retirement home.

- Average Brit spends £28,952 moving house in a lifetime, compared to £75,972 spent by Londoners;

- A single home move in London costs £20,739 compared to £8,264 in UK*;

- The cost of a home move is equivalent to 31% of average annual national earnings, rising to 61% for Londoners;

- Estate agent fees are 80% higher than stamp duty for majority of movers;

- First time buyers have considerably lower move costs.

Comment

Interesting to see how small the cost of removals is as a proportion of the total moving cost. Should we be charging more?