The UK road user levy came into force on 1 April, 2014.

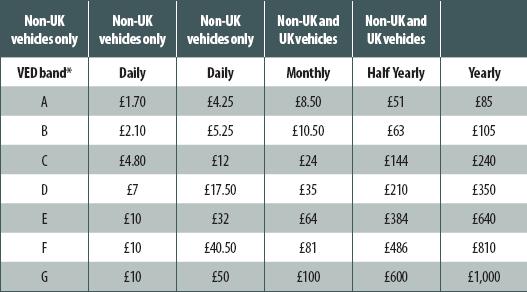

The levy covers all goods vehicles (HGV), 12 tonnes or more and is intended to make sure that these vehicles, wherever they are from in Europe, make a contribution to the wear and tear of the UK road network. The charge varies according to a vehicle’s VED band and the time it spends in the UK.

UK registerd vehicles will pay levy costs at the same time and in the same transaction as vehicle excise duty (VED) with payments collected by the DVLA. VED will be reduced and, consequently, over 90% of UK operators will not see costs rise.

UK registerd vehicles will pay levy costs at the same time and in the same transaction as vehicle excise duty (VED) with payments collected by the DVLA. VED will be reduced and, consequently, over 90% of UK operators will not see costs rise.

Non-UK registered vehicles must make levy payments before entering the UK. The levy can be paid by day, week, month or year and discounts are available. Payments can be made online, by telephone or at point of sale terminals on ferries and at truck stops. Companies working from the Channel Islands and Isle of Mann will also be affected.

The introduction of a charging scheme for foreign hauliers is something the industry has been demanding for a long time. Failure to pay the levy is a criminal offence, attracting a £300 fixed penalty notice – or in the case of foreign HGVs, a deposit taken at the roadside.

This new legislation will be applied to the 130,000 foreign HGVs that visit the UK every year making approximately 1.5 million trips.

Photo: Non-UK registered vehicles must make levy payments before entering the UK.