The latest Hometrack UK Cities House Price Index has revealed that the gap between average earnings and house prices has reached an all-time high in London.

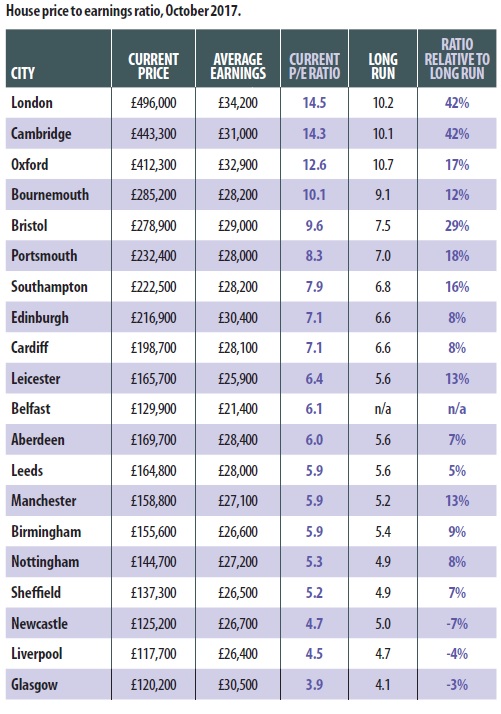

The price to earnings ratio in the capital is now 14.5 x average earnings which is 42% higher than the average for the last 15 years. Behind London, Cambridge (14.3), Oxford (12.6) and Bournemouth (10.1) have also recorded double digit price to earnings ratios, while strong house price inflation in Bristol has pushed its ratio to 9.7 x average earnings.

In contrast there are three cities - Glasgow, Liverpool and Newcastle - where the current house price to earnings ratio is lower than the 15-year average. Notably, in most cities outside the south-east the difference between average earnings and house prices has remained largely unchanged over the past 15 years.

During that time there has been a wide variation in city level house price growth. For example, in London and Cambridge prices are 60% higher than in 2007 while in Glasgow and Liverpool they remain lower than a decade ago. In Leeds, Manchester and Birmingham the house price to earnings ratio is between 5%-13% higher than the 15-year average. Despite the recent increase in the base rate of interest, house prices in regional cities are likely to increase further, given their current affordability levels.