It is surprising how many businesses in our industry are unaware of the potential risk of exchange rate volatility, particularly if they make or receive regular international payments.

In this article, Greg Smith from currency transfer expert Hawk FX provides some guidance on how to understand the fundamentals of foreign exchange (FX), its impact on profits and how to manage that risk.

The basics

The exchange rate is simply how much of one currency you get, when you are buying or selling a different currency - a ‘currency pair’ - for example, converting British pounds (GBP) to euros (EUR). The most important factors in getting more out of your international money transfers are:

- Getting better exchange rates and avoiding fees.

- Managing your exposure to currency market fluctuations

Currency transfers

Currency specialists are completely focussed on currency markets so provide a range of services that help you get the most from your currency transfers and protect profits.

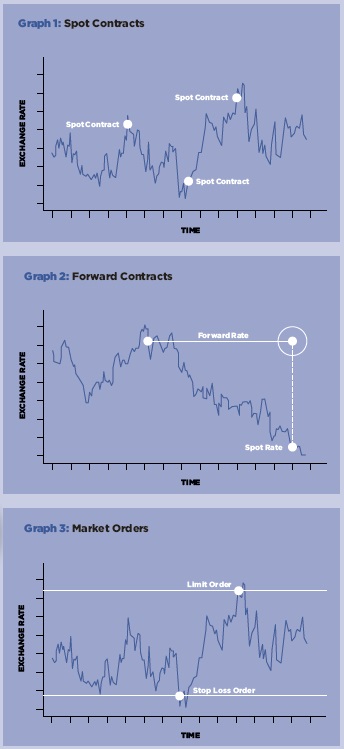

Spot Contracts – I need to send money right now

On the ‘Spot’ Contracts are a straightforward way to send money, and you get the prevailing exchange rate at that moment in time when you decide to send your money. Transfer times range between the same day or up to two days, depending on the currency you are exchanging and the destination country.

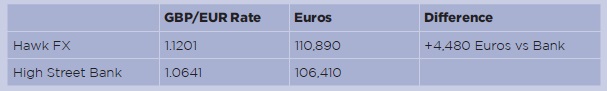

Banks vs currency transfer specialist

High Street banks are most commonly the first port of call. However, they usually do not offer the best exchange rates and you can be hit with fees. Specialist currency exchange providers can deliver better exchange rates and normally without any exorbitant bank fees.

The differences can be as much as 4%, which may seem small, but quickly add up to be significant amounts of money.

The table below shows the impact of seemingly small differences to the exchange rate between Hawk FX and high street banks for a transfer of £100,000 pounds to euros in mid-May 2020.

Forward Contracts – I want certainty around the exchange rate

You have a known future requirement and want to ensure there are no surprises with the exchange rate moving in an unfavourable direction. Then a ‘Forward Contract’ could be the right solution for you. It is possible to lock in an exchange rate for up to two years for a small deposit.

Market Orders – No payment deadline, but want to take advantage and be protected

Market Orders – No payment deadline, but want to take advantage and be protected

Market orders are a special type of order that we use to help you take advantage of fluctuating currency exchange rates. They are highly effective if you are not limited by payment deadlines, since you can:

Limit Order — Set a rate you want to make your money transfer at — They will not make the transfer until that rate is met. This ensures you do not need to sit in front of your computer just so you do not miss out on a great exchange rate!

Stop Loss Order — Protect your money from falling exchange rates, by setting a ‘lowest price’ you want to exchange at, this limits any potential losses and acts as a ‘safety net’ for your transfer.

Normally both are used together to aim for a favourable exchange rate whilst also ensuring that, should the markets turn, you are protected.

Business Risk – How is my business exposed and what is the best solution?

Before deciding on any solution/strategy, it is necessary to understand the impact of exchange rates on your business. Currency transfer specialists can prepare a detailed Business Exposure Report that will help you take stock of your business’s FX exposure before deciding on any plan or solution.

The financial markets have seen unprecedented volatility due to a multitude of factors including Brexit, USA – China trade war and now coronavirus. Many businesses have been struggling to manage their FX exposures, or have simply been unaware they are losing money to poor exchange rates.

Check you have a sound FX strategy for your business, and you are consistently getting the best exchange rates.

Greg Smith

Greg Smith

As an international business growth specialist, Greg has many years' experience helping multinationals develop effective FX strategies and decisions - improving profitability and reducing FX risk. Greg brings the same business platinum support and guidance, previously the afford of big business, to ambitious companies doing business overseas.

Contact Greg Smith at Hawk FX

Phone: +44 (0)330 380 30 30

E-mail: greg@hawkfx.com

Web: www.hawkfx.com

Photo: Greg Smith