There will be short-term savings for movers, says industry comparison specialist Compare My Move, but this is offset by long-term EV uncertainty.

The UK’s 2025 Autumn Budget has opened the door to a new form of EV taxation.

Although the upcoming per-mile charge applies only to personal electric vehicles for now, it sets a clear precedent: electric transport will increasingly be taxed by distance driven, rather than through fuel duty at the pump.

At the same time, the Budget introduced measures that lower short-term costs for petrol and diesel vehicles, including a continued freeze on fuel duty and the rollout of a new fuel-price finder tool.

Dave Sayce, Managing Director and Founder of Compare My Move, comments: “Most removal companies still rely on diesel vans, so the freeze in fuel duty and the upcoming fuel-finder tool will provide some welcome stability in operating costs. In the short term, this should help keep the cost of moving home slightly lower, especially for long-distance jobs where fuel makes up a large part of the bill.

“Electric vans aren’t currently subject to the new per-mile charge, but this Budget does signal that the government is open to road-pricing in future. For companies that have invested in low-emission vans, there’s understandable concern that a similar tax could eventually apply to commercial vehicles too. For now, though, diesel removal fleets are the ones seeing the most immediate benefit.”

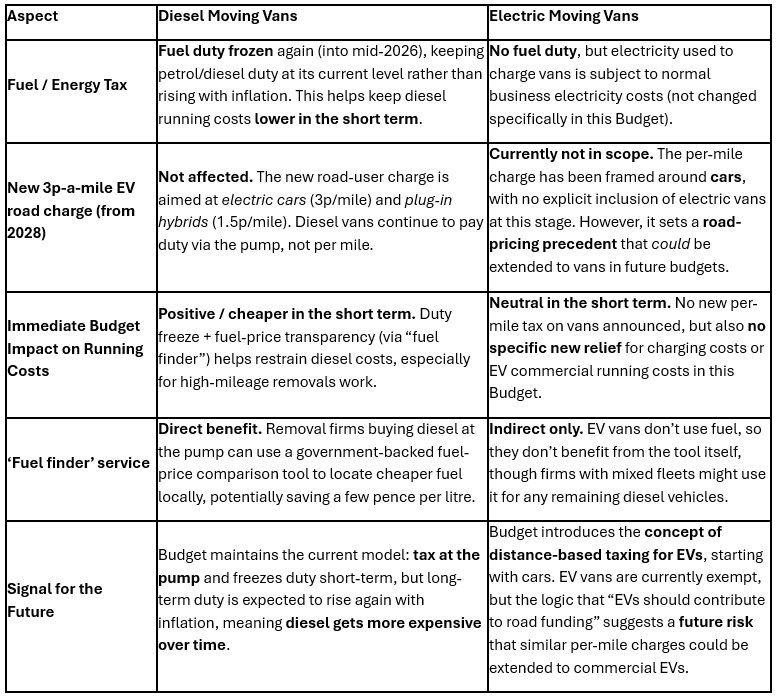

So what does this mean for diesel moving vans compared with electric moving vans?

The table below breaks down how each part of the Budget affects both types of vehicles.