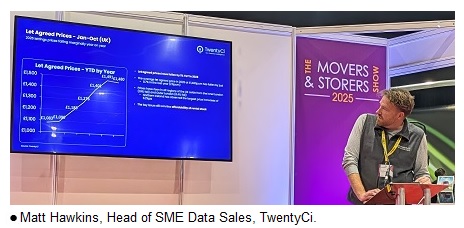

At the recent Movers and Storers Show, TwentyCi’s Head of SME Data Sales, Matt Hawkins, led a seminar covering the UK’s property and home-mover market in 2025 - and the outlook for 2026.

The UK property market enters 2026 with surprising resilience. Despite persistent cost-of-living pressures and gloomy headlines, the data tells a far more positive story for movers, storers and removals firms. Activity levels remain strong, supply is at record highs, and demand continues to favour the types of homes that generate the most valuable home-mover opportunities.

Transactions between January and October 2025 were 11% higher than in 2024, with HMRC recording over one million transactions during that period.

While April and May 2025 saw a temporary dip – largely attributed to the “post–stamp duty hangover” – activity rebounded strongly in June, July and September. These gains have pushed overall transaction levels comfortably above the same period in 2024, reinforcing one clear message: people still want to move.

Supply at a decade high

One of the standout themes of the market is supply. New property listings have reached levels not seen in the past ten years.

- 1.64 million properties were listed for sale between January and November last year – up 2.3% year-on-year.

Crucially for removals firms, this growth is concentrated in the most commercially attractive price bands. Properties priced between £200k–£350k (up 3%) and £350k–£1m (up 2.8%) have shown the strongest increases in supply. These are the same brackets that consistently drive the bulk of home-mover volumes.

Outer London has been a particular standout, with new instructions up 5.5% year-on-year, while the only regions not to see growth was Northern Ireland and the North West.

Robust demand

Supply has not risen in isolation. Buyer demand has strengthened in parallel, with Sales Agreed up 2.9% between January and November 2025 compared to 2024..

More than 1.2 million properties had, by November, already agreed a sale in 2025, exceeding both 2023 and 2024 levels.

Demand has been strongest in:

- Wales, up 6.8% year-on-year;

- East Midlands, up 6%.

The only regions to see declines were Northern Ireland and London, where Sales Agreed fell modestly year-on-year.

Once again, the most active price bands were £200k–£350k (up 4.9%) and £350k–£1m (up 4.1%). These segments represent excellent news for removal and storage companies, pointing to a healthy pipeline of home-movers through into early 2026.

Property types

While demand and supply have increased across all property types, detached and semi-detached houses continue to dominate buyer interest. The demand-to-supply ratio for detached homes has risen by 4.2% year-on-year, underlining strong competition for larger family properties.

For the removals and storage sector, this is particularly encouraging. Larger homes typically mean fuller vans, packed lofts, overflowing garages – and a greater likelihood of short- or long-term storage requirements alongside the move.

Timing Is everything

Understanding market timing is critical for targeting home-movers effectively ...

Click here to download the latest market data.

Note: In this report, supply and demand data is dated January to November 2025 and transactional data is dated January to October 2025.

Click here to read the full story in The Mover magazine.